A strategic industry with a future

Tanks, drones and high-tech: Germany’s arms industry is growing rapidly and is at the heart of Europe’s security interests.

Germany’s defence industry is not just a sector like any other. It is of strategic importance to the security and defence capability of Germany, Europe, and the entire NATO alliance – especially in the light of the growing threat posed by Russia’s war of aggression in violation of international law against Ukraine. Thanks to its innovative strength, Germany’s arms sector makes a key contribution to equipping the Bundeswehr and its allies – but also to the capacity of German industry as a whole.

Systems providers and strong SMEs

Germany’s defence industry consists mainly of small and medium-sized enterprises (SMEs), clustered around a few major “systems providers”. These include companies such as Rheinmetall, Airbus, Krauss-Maffei, Hensoldt and Diehl, which produce complex weapons systems. According to the Federal Ministry for Economic Affairs, the arms sector employs 105,000 people and generates revenue of 31 billion euros – and it is growing fast.

After military procurement by the Bundeswehr declined following the Cold War, Germany’s arms industry succeeded in maintaining its position through international competition. Export trade became its new focus – experts estimate it now accounts for around 70 per cent of value creation. Germany is thus the world’s fifth-largest arms exporter, according to the Stockholm International Peace Research Institute (SIPRI). The most important German defence company globally is Rheinmetall, ranked 26th among the world’s largest arms manufacturers by SIPRI. The growing Düsseldorf-based group is considered one of the key producers of tanks (such as the Leopard 2) and ammunition, with a global production network. Rheinmetall is currently expanding its largest site in Unterlüß, Lower Saxony, by adding a new munitions plant at a cost of 300 million euros.

Heckler & Koch, maker of machine guns, pistols and grenade launchers, also has a full order book. The company is hiring skilled workers and investing in expanding its sites.

The sector is particularly strong in Bavaria, where it generates about a third of its total value. This is due to Bavaria’s significance as a centre of Germany’s aerospace industry and the emerging drone industry located there, with manufacturers such as Quantum-Systems and Helsing. Both supply Ukrainian forces with reconnaissance and combat drones. In 2025, Helsing received another 600 million euros from investors. Among other things the company is working on an artificial intelligence system designed to operate fighter jets in complex aerial combat scenarios.

Leading position in weapons for land forces

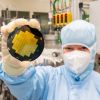

However, the core strength of Germany’s arms industry lies in traditional main weapons systems such as armoured vehicles, submarines and naval ships. In this area – particularly in microelectronics – it is able to draw on a broad base of domestic suppliers. The Kiel-based company Thyssenkrupp Marine Systems (TKMS) is the global market leader in non-nuclear submarines and is booked up with contracts worth at least 18 billion euros through to the early 2040s.

German defence manufacturers hold a leading position in weapons systems, vehicles, equipment and technologies for land forces. They are setting global standards in the digitalisation of weapons systems. For instance, Rheinmetall’s “Lynx” model is in the final round of selection for the new infantry fighting vehicle of the US Army. Digitalisation is advancing rapidly in land systems production – helped by the close relationship with the automotive sector. Moreover, the arms industry is increasingly using production facilities and skilled workers from the mobility sector, which is currently undergoing a transition.

High demand due to security situation

The Federal Government has welcomed NATO’s decision to raise defence spending to 3.5 per cent of GDP – up from the previous 2 per cent – and provide an additional 1.5 per cent for military-use infrastructure. Accordingly, demand for German-made arms is rising rapidly. To manage this increase, Germany’s defence industry has one central demand: “It would be good if customers in Europe could harmonise and pool their needs as much as possible. The industry now needs clarity on what quantities of which products are expected by when,” says Hans Atzpodien, chief executive of the Federation of German Security and Defence Industries (BDSV). So far, countries tend to order individually and with their own special requirements, which makes efficient production harder.

Now more than ever, Germany’s arms industry must make strategically smart decisions – in close consultation with the Federal Government, the Bundeswehr, the EU and allied countries. After all, it is not just a sector like any other.