In the laboratory of the future

Germany’s pharma and medical technology industry stands for high tech, innovation and medical progress. It requires reliable framework conditions, however.

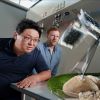

A sterile room, the hum of equipment, concentrated faces behind protective goggles. Biochemists in a clean room at a pharmaceutical research centre pipette a newly synthesised substance into a cell culture. It might turn out to be a molecule that will transform the lives of millions of people. But what is the likelihood of that being the case? A mere 0.02 percent. And yet German pharma companies invest enormous sums into potential new drugs each year.

Drug innovations with global impact

During the course of its history, the German pharma industry has produced phenomenal medical innovations in many areas. During the pandemic, for example, the Covid-19 mRNA vaccine developed by BioNTech saved lives worldwide. Besides the “classic painkiller” aspirin, Bayer has developed drugs to treat liver and kidney cancer. Products placed on the market by Boehringer Ingelheim include drugs to treat type 2 diabetes and pulmonary fibrosis. Merck developed an immune checkpoint inhibitor for certain types of cancer. And STADA’s biosimilar antibodies are affordable alternatives to costly biological medicines. These are just a few examples from a long list.

A race against time

Medical innovation is expensive, however - developing a new drug can cost as much as four billion euros. It is also a laborious process: of the roughly 10,000 substances investigated, on average only one obtains approval after overcoming all the obstacles over a period of eight to twelve years. The first step is to conduct preclinical trials - in the lab and on animals - to clarify the toxicity and effectiveness of the new substance. Only then can clinical studies with human participants begin. These are divided into three phases: Phase I tests how well the drug is tolerated by healthy volunteers. Phase II tests the efficacy of the drug on patients, while Phase III then involves large-scale studies of several thousand participants to assess the drug’s efficacy, side effects and correct dosage. Only once a drug has met the study’s objectives in Phase III does the complex approval procedure get underway.

With 524 industry-initiated clinical studies, Germany ranked fourth worldwide – after the USA, China and Spain - in 2022. It is clear that clinical studies not only result in scientific progress but also ensure that patients gain quicker access to new treatments.

A strategy for Germany

The investment risk is high, however - and the framework conditions are extremely complex. The German government presented its National Pharma Strategy in 2023 with a view to securing the supply of pharmaceuticals, accelerating access to innovations and boosting Germany’s competitiveness as a location for the pharma industry. Its central elements include expanding research and development, investing in production capacity and reducing bureaucratic hurdles.

“The German government’s Pharma Strategy marked an important milestone in terms of improving conditions for the industry. By providing targeted support for innovation clusters and simplifying administrative processes, Germany can achieve a crucial edge over its international rivals,” says Han Steutel, president of the German association of research-based pharmaceutical companies.

Focusing on new treatments

Around three quarters of the 30 drugs with new active ingredients that were placed on the German market in 2023 were targeted at cancer or immunological and infectious diseases. Over half of these are based on genetic engineering methods - biopharmaceuticals that are produced in living cells or organisms. Nearly 400 biotechnology-based drugs with over 350 active ingredients are currently approved in Germany. Gene and cell therapies offer new opportunities to not only alleviate but cure complex diseases. Personalised medicine is tailored to the patient’s individual genetic, molecular and clinical characteristics in order to maximise efficacy and minimise side effects. Artificial intelligence is also revolutionising pharma research by analysing huge quantities of data to more rapidly identify substances of potential benefit, assess risks at an earlier stage and plan clinical studies more efficiently.

Medical technology - the inconspicuous giant of the healthcare sector

Just how seamlessly scientific findings can be translated into practical applications is demonstrated by the medical technology industry – a major sector with numerous German companies that are highly successful yet tend to attract less attention than pharma companies. “Germany’s medical technology sector is one of the most advanced and important industries nowadays. With its innovations and developments, it contributes to improving healthcare and making the lives of patients worldwide easier,” says Marc-Pierre Möll, CEO of the German Medical Technology Association. Be it cardiac pacemaker implants, artificial joints, prosthetics, highly precise surgical instruments or computational imaging - over 450,000 German medical technology products are in use around the globe.

Social engagement on the part of pharma and medical technology companies

German pharma and medical technology companies may be profit-oriented, but they also demonstrate social responsibility at the same time. They campaign worldwide for easier access to healthcare - especially in developing countries and emerging economies. One example is the German Network against Neglected Tropical Diseases (DNTDs), in which German firms take part in initiatives to combat diseases such as Chagas’ disease, sleeping sickness or lymphatic filariasis. In cooperation with the World Health Organization (WHO), they make drugs available free of charge - to treat worm and infectious diseases for example.

The German pharma industry

Germany has some 700 pharmaceutical companies employing a total of 133,000 people. 84 percent of these are small and medium-sized enterprises. In 2023, sales of the German pharma industry remained stable at nearly 60 billion euros. Exports account for 63 percent of their sales. German pharma companies invested 9.4 billion euros in research and development in 2022. Fixed asset investments grew significantly to over 3.3 billion euros in 2023 - an increase of 32 percent on the previous year.

The German medical technology sector

With around 1,500 companies, the medical technology sector employs more than 212,000 people in Germany. It is extremely well connected globally, with sales of over 55 billion euros and an export rate of 68 percent. Germany’s leading medical technology firms include B. Braun, Siemens Healthineers, Drägerwerk, Karl Storz, Fresenius, Heraeus, Ottobock and Carl Zeiss Meditec.